GoSteward

- Invested amount

- $3,600.00

- Realized returns

- 8.00% Interest

The American humorist Will Rogers once quipped, “Buy land. They ain’t making any more of the stuff.” And apparently, Bill Gates, Warren Buffett, and countless hedge funds are taking the advice seriously. Buffett bought his first farm before high school in Nebraska for $10,000 and Bill Gates has amassed more than 270,000 tillable acres.

It turns out that farmland is a remarkably solid investment. Over the past 30 years, the average inflation-adjusted return is around 5% – and much higher when you adjust for risk. After all, farmland is a hard asset where you have a productive tenant paying a long-term lease. That’s steady income that’s relatively risk-free compared to stocks.

But before you jump into the farmland investment craze, consider this: Aren’t we creating the same sorts of problems we’re seeing housing market? A wealthy subset of investors own a hard asset (housing/land) that’s leased to renters/farmers. That creates a virtuous cycle for investors and a vicious cycle for renters/farmers as land prices and rents increase.

Steward offers a better way to invest in agriculture: Using the Regulation Crowdfunding platform, you can invest in farmers rather than farmland and support better food systems. Human-scale producers struggle to access loans from conventional banks, which is a good fit for investors to support sustainable agriculture and generate attractive returns.

Getting Started

Steward makes it easy to get started with as little as $100. Using the online platform, you can choose between lending to individual projects (that typically sell out in a few hours) or to the Steward Regenerative Capital fund – a “mutual fund” of sorts with a portfolio of borrowers.

These investments are structured as loans paying a fixed interest rate over a set period of time. For example, at the time of writing, the Steward Regenerative Capital fund is a 9-month loan at a 6.5% APR with a $100 minimum and nearly $20 million raised to date. These loans are typically repaid monthly, creating an attractive cash flow for investors.

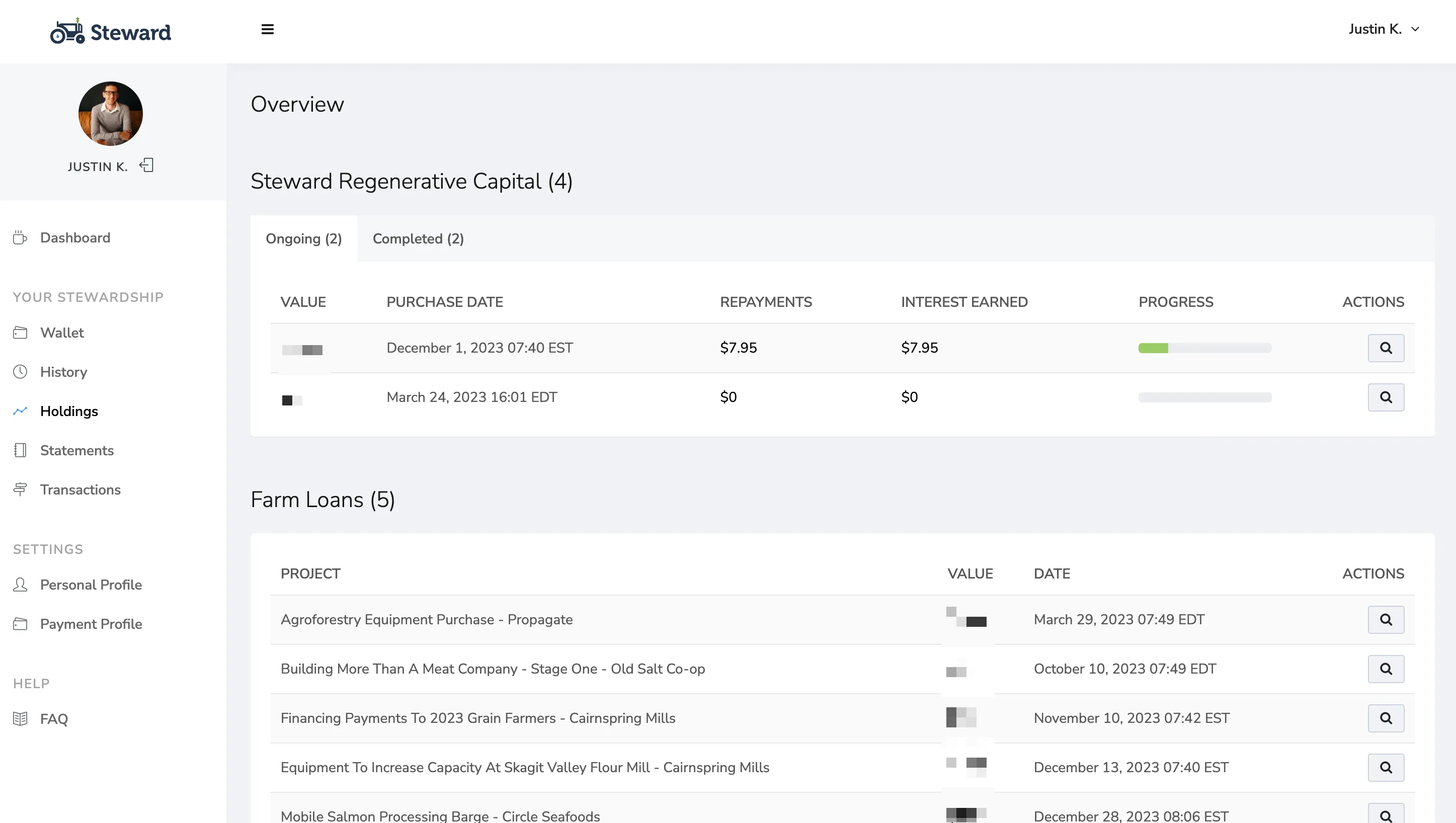

After logging in, you can see different lending opportunities and the status of your portfolio. The interest payments you receive go into a “Wallet” where you can reinvest or withdraw the funds to a bank account. Meanwhile, the “Holdings” page shows you the process of various loans, the interest payment schedule, and other information.

The platform’s ease-of-use and the investments’ simplicity make this an excellent platform for those just starting out with impact investing. There’s less risk than many equity-like impact platforms and the repayment amounts of very steady and predictable.

Risk & Return

Steward’s interest rates vary widely between projects. While the Steward Regenerative Capital fund offers a modest 6.5% APR, individual offerings have reached a nearly 10% APR.

But, what about the risk?

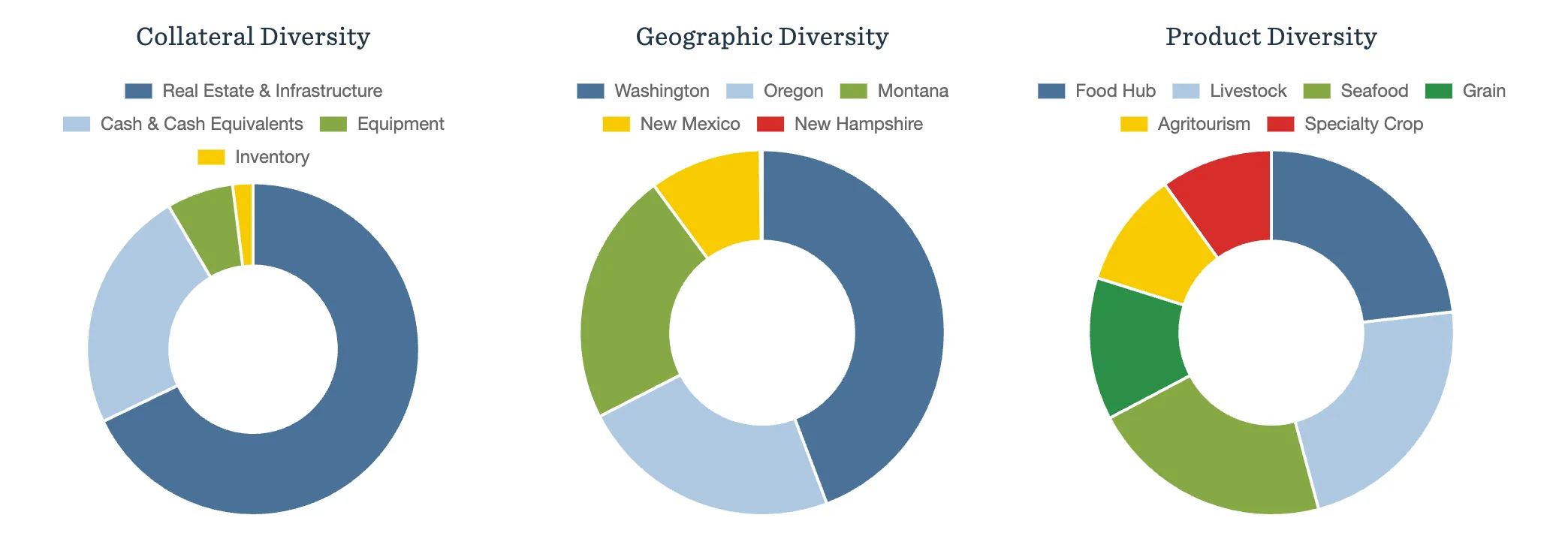

The most compelling feature of Steward for me is the secured nature of the loans. Since many loans help purchase equipment, they’re typically backed by the equipment being purchased, real estate, or other business assets. So, if a borrower defaults, there’s a lot more recourse than any equities and many other types of preferred stock or bonds.

The other compelling feature is the monthly repayment schedules. While most dividend funds or bonds make quarterly distributions, Steward’s loans make monthly repayments, providing a more helpful cash flow for those relying on the income to cover living expenses.

And finally, the Steward Regenerative Capital fund offers a lot of diversification, which spreads out risk and could improve the risk-adjusted return.

Impact

Sustainable agriculture isn’t as sexy as renewable energy, but it’s arguably one of today’s underappreciated problems.

There’s no doubt agricultural industrialization has helped eliminate a lot of food insecurity – genetic modifications increase a crop’s hardiness against pests and diseases, pesticides prevent widespread crop loss from common pests, and cutting-edge machinery helps reduce cost.

But, of course, these benefits come at a cost.

Herbicides and insecticides have been associated with acute poisoning and long-term chronic illnesses; water pollution from fertilizer contaminates downstream drinking water supplies, and livestock antibiotics have accelerated the development of resistant bacteria. At the same time, seed monocultures have depleted soil fertility, resulted in less drought tolerance, and led to a loss of biodiversity. And that’s not to mention the loss of mid-sized farms and the cost to local governments to deal with things like algae blooms.

By lending to human-scale farming operations, you can help counterbalance these trends by filling the funding gap for smaller borrowers and promoting sustainable practices. More funding could help turn these smaller operations into larger organizations that make a real difference over time. And Steward helps you impact everything from salmon farms to cattle ranches.

Closing Thoughts

Steward enables you to invest in high-yield, asset-backed loans that support sustainable, human-scale farming operations. While it doesn’t offer the highest rate, the Steward Regenerative Capital fund’s attractive yields, built-in diversification, and impact make it a great alternative to money market funds or some bond portfolios.