Energea

- Invested amount

- $12,464.37

- Realized returns

- 11.60% IRR

Suppose you want to invest in renewable energy. You could install solar panels on your house. While that would provide some returns, it’s highly dependent on where you live (e.g., solar radiance) and your existing energy bills. And, of course, the amount you invest is limited to how much solar capacity your utility allows you to install.

You could also buy a renewable energy ETF holding a basket of solar, wind, and other stocks. But then, you’re buying shares from other investors rather than directly funding renewable energy projects. In some ways, that pads someone else’s profits more than address the problem of climate change. And worse, these stocks tend to be quite volatile.

Energea offers a great solution: They setup and operate private companies developing solar projects around the world. Then, through Regulation Crowdfunding, they sell ownership interests in these companies to accredited and non-accredited investors. And the capital they raise directly funds the development and operation of these projects.

Investors generate income when these projects start selling the electricity they generate. The buyers are utilities and large businesses through 20-year, inflation-adjusted power purchase agreements. And that translates to an attractive income steam that blends equity-like returns with bond-like stability – all while supporting renewable energy.

But, while the company’s unique model and compelling returns make it an integral part of my impact portfolio, there was a bit of a learning curve and a few surprises.

Getting Started

Most Reg CF platforms provide very little engagement and communication. In some cases, you’re expected to cut a check and wait a few months or years, making it less like stock investing and more like venture capital investing.

Fortunately, Energea’s online investment platform is the polar opposite and really sets the bar for other companies operating in the Reg CF space.

You can easily make a one-time investment in individual projects or choose Energea Core to automate investments in multiple portfolios each month. The entire process takes just a few minutes and the most complicated decision you’ll make is deciding what percentage you’d like to invest in different projects (each with a different risk and return).

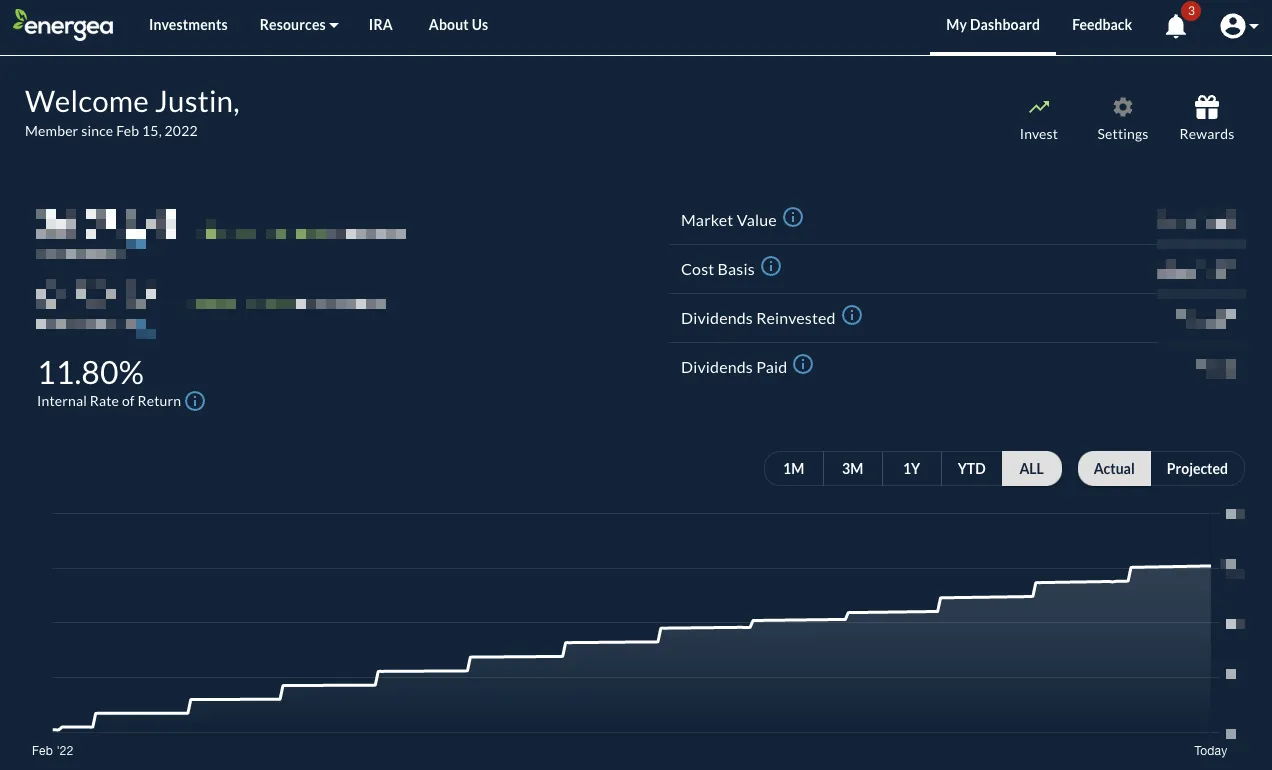

After you’ve made a purchase, the company’s dashboard shows you your market value, total dividends, and internal rate of return. You can also see your actual and projected returns over different time periods to help you with financial planning.

Of course, since we’re all impact investors here, you can also see your impact in terms of tons of CO2 reduced, homes powered for one year, smartphones charged, and trees planted. These are helpful ways to compare impact between different investment options.

But my favorite part of Energea is the communication. Before you even sign up, you can book a meeting with a real person that can help answer all your questions. And after you’re an investor, you receive monthly email updates and invites to quarterly conference calls where management holds an in-depth discussion of the projects. It’s a breath of fresh air in the Reg CF space.

The only missing piece – which management keeps acknowledging they’re working on – is a mobile app. But they expect to launch that sometime in mid-2024.

Risk & Returns

Energea initially caught my attention with its promise of juicy double-digit returns. As of early 2024, the company’s realized returns surpassed 12% on $121 million of assets under management. These are equity-like returns for what you’ll see is more like a bond.

The big question is: How risky are these returns?

After all, you could double your money overnight by investing in out-of-the-money call options expiring tomorrow – but these are high-risk, and you’d lose money 99% of time!

Energea’s business model is a lot like buying a hotel, except every room is rented for 20 years before breaking ground on construction. The primary costs are real estate leases and (rarely) debt service, while its revenue is backed by 20-year power purchase agreements (PPAs).

These PPAs are also inflation-adjusted. That’s important because these projects receive revenue in local currency that must be converted into U.S. dollars. If the local currency experiences inflation, the PPA customers would owe more of the local currency. These dynamics are similar to the commodities market, where the price of oil remains constant across different currencies.

That said, there’s still a currency risk because of the relative valuation versus the U.S. dollar. If the local currency strengthens against the dollar, projects could become more expensive to build and hurt the profitability of these investments in the construction phase.

And finally, there’s things like construction risk, natural disasters, or lower-than-expected solar irradiance. To mitigate these risks, the company holds various insurance policies covering everything from theft and unexpected damage to business interruptions. While solar irradiance (e.g., unusually cloudy weather) is possible, diversifying across multiple projects around the world can help mitigate these risks and even out returns.

Fees are the final piece of the puzzle.

Energea operates like a hedge fund in this regard with a 2% management fee and 20% to 30% carried interest (e.g., a 2-and-20 fee structure). While that’s a bit pricy for most equity investments, the company is responsible for sourcing, building, and managing these projects, so there’s a lot more overhead than simply maintaining a portfolio of stocks.

The 2% management fee comes out of monthly distributions from its projects. But if a project doesn’t cash flow, the company does not take a management fee.

In addition to this fee, they charge a 20% to 30% carry on returns above 6% (Solar in the USA) or 7% (Brazil and South Africa). While these fees take a bite out of high returns, they incentivize the management team to surpass these minimum returns. And since they don’t earn a carry below these levels, it’s likely Energea feels they’re pretty attainable.

The realized returns, risk factors, and fees all look acceptable (even compelling) but how do you measure these returns relative to conventional stocks or bonds? Or, in other words, how does the company set a price for their investments?

Well, this is where things get a little confusing and, hopefully, I can help shed some light!

Since Energea shares don’t trade on a public stock exchange, the company needs to determine a fair share price at a given point in time. This price must balance what has happened thus far in the portfolio with what is expected to happen in the future. After all, it wouldn’t be fair to charge a pre-construction investor the same per-share amount as a late-stage investor since the pre-construction investor wouldn’t receive any cash returns for some time.

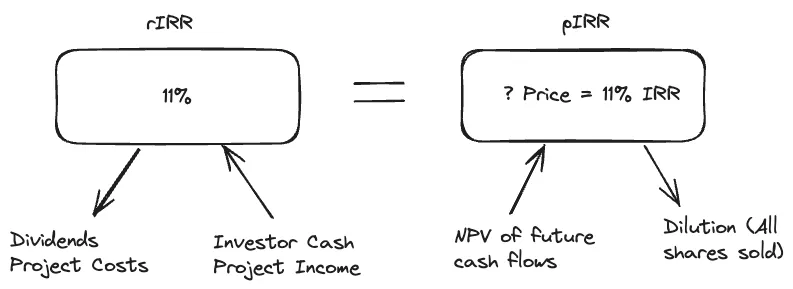

The company solves this problem by using a goal seeking method to make sure the returns you’ve realized so far (realized internal rate of return) equal the returns you expect to get in the future (projected internal rate of return).

The realized IRR is the return on investment that all current investors have seen. This looks at all the money that’s come in and gone out until now. Moreover, it considers the current value of all shares that haven’t been sold yet at a share price “X”.

The projected IRR is the expected return on investment for someone who invests $1 at the current share price “X”. To figure this out, you first need to determine what portion of the project this $1 investment buys, which depends on how many shares are outstanding and their price. The calculation assumes the worst-case scenario where all available shares are sold immediately, which would dilute the $1 investment the most. Then, you calculate the return this $1 would get based on the future money the portfolio is expected to make, minus fees.

If you then set rIRR = pIRR, you can determine the share price “X” using a trial-and-error process (typically with a financial calculator or Goal Seek in Excel).

And once a project no longer has any capital requirements, there are no more shares available to purchase and the cash flows become the exclusive source of returns.

Impact

Investors seemingly have a lot of options to support the renewable energy transition, from individual stocks to exchange-traded funds. But unless you’re buying in an initial public offering (IPO), your dollars are being sent to another investor in a “secondary market” transaction. In other words, you’re buying someone else’s shares, not funding the company’s projects.

Now, of course, there are knock-on effects associated with a vibrant secondary market. For instance, if there’s a lot of shares trading and their value is trending higher, it’s much easier to raise more capital on better terms. But nonetheless, as an investor, your actual dollars may very well be padding someone else’s pockets more than funding the outcomes you want to see.

Energea is one of the few ways to directly fund renewable energy projects. The company raises capital from investors and then deploys that capital to build projects. Until recently, there were no secondary market transactions at all. While they did introduce a small secondary market to provide some liquidity (a benefit to investors), the lion’s share of transactions are primary market and going directly towards building these projects. Moreover, the secondary market doesn’t involve any speculation since valuations are set by the company, so there’s no risk of your money padding the pockets of former investors via a speculative increase in valuation.

Closing Thoughts

Energea is my favorite impact investing platform and one of my largest holdings. I think the renewable energy transition is incredibly important and they offer a way to support positive change while earning a very attractive return.